Due to the open-source nature of the blockchain, new cryptocurrencies have emerged with new value-adding features for their holders. One of these features is the ability to receive dividend-like payments.

For example, Proof of Stake (PoS) cryptocurrencies pay “interest” to their holders for staking their coins to secure the network. Moreover, some digital tokens issued by exchanges pay their holders a share of their trading fee income.

Here’s a look at the ten best dividend-paying digital currencies and tokens that you can invest in to earn passive income as a cryptocurrency investor.

Top Dividend-Paying Cryptocurrencies

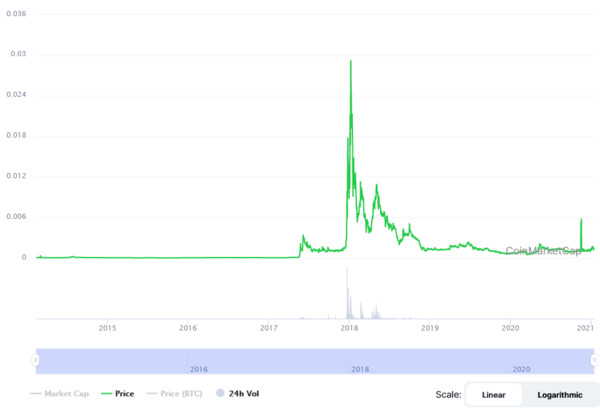

VeChain (VET) – Score: 4.5

VeChain operates as a platform for smart contracts, similar to NEO and Ethereum. However, unlike those platforms, VeChain pays “dividends” in the form of VTHRO coins.

The payout is at a rate of 0.00042 VTHOR tokens per day per staking of 1 VET. Dividends can be received either on a monthly basis or every second. For a 365-day year, the dividend rate per 1 VET is 15.33% in VTHOR tokens.

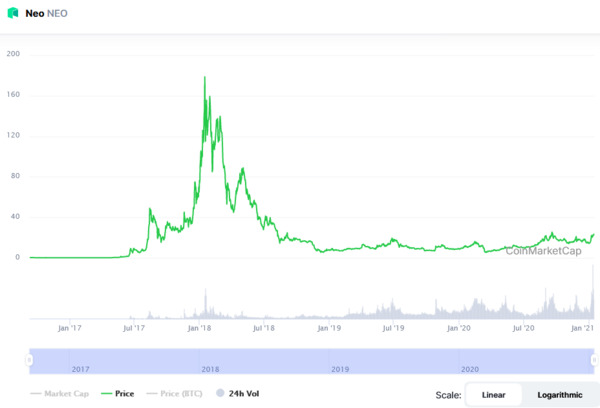

NEO (NEO) – Score: 4.5

NEO – formerly known as AntShares – is one of the most popular blockchain projects in the market, often dubbed the “Chinese Ethereum.” NEO token holders can receive up to 5.5 percent “interest” per annum for staking their tokens. Payments are received in the NEO blockchain’s second token, NEOGas.

Unlike other Proof of Stake (POS) coins, NEO doesn’t require you to keep your staking wallets constantly open to receive dividends. GAS coins can only be claimed in certain wallets, so be sure to research wallets if you plan to earn dividends by staking NEO tokens.

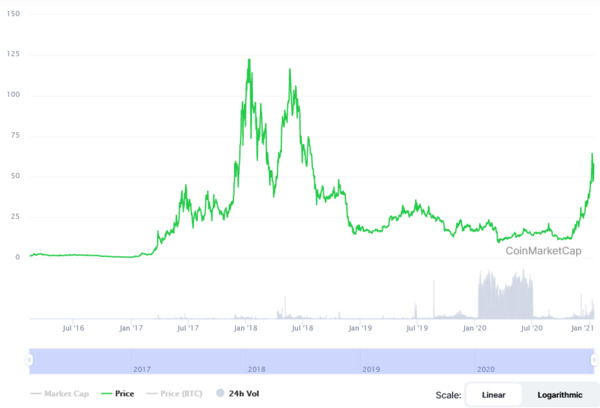

Decred (DCR) – Score: 3.5

Decred is an autonomous digital currency that was launched in 2016. Decred uses a hybrid consensus mechanism model composed of Proof of Work and Proof of Stake to secure the network. As a result, DCR holders who stake their coins can earn up to 30 percent “dividend” per annum.

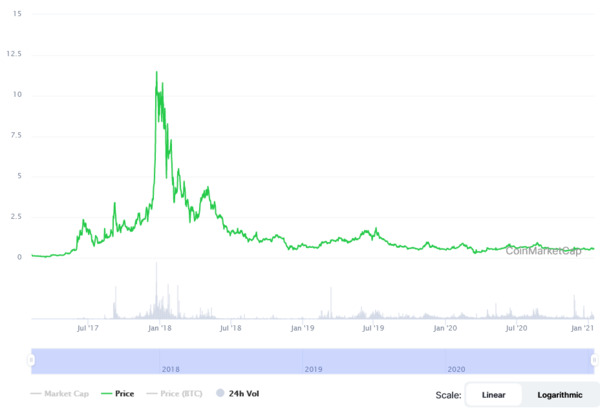

Komodo (KMD) – Score: 3.5

Komodo was launched in 2016 as a privacy-centric digital currency that leverages Zero-Knowledge Proofs to enable users to make private financial transactions. The Komodo platform also enables startups to launch dICOs (decentralized ICOs), a decentralized exchange, and blockchain development solutions.

Moreover, Komodo holders can receive up to 5 percent “interest” per annum by having more than ten KMD in their wallets. Unlike pure staking, holders don’t need to keep their wallets open at all times. They just need to hold KMD in a wallet and move it around yearly.

KuCoin Shares (KCS) – – Score: 3.0

KuCoin Shares is an ER20 token that was launched by the Hong Kong-based digital currency exchange KuCoin. KuCoin holders can receive “dividends” – in the form of different digital tokens – as KuCoin distributes 50 percent of its trading fee revenues to its token holders.

As trading fee revenues depend on fluctuating trading volumes, “interest” payments vary each month.

PIVX (PIVX) – Score: 3.0

PIVX (Private Instant Verified Transactions) is a privacy-focused digital currency that was launched in 2016 as a code fork of Dash to provide users with anonymous financial transactions using its “sub-currency” zPIV.

PIVX uses the Proof of Stake Zerocoin protocol which enables users to stake their coins to secure the network. As a reward, users who stake their coins will receive new PIVX coins that amount to around 4.8 percent interest per annum. Wallets must be open and online for a specified amount of time in order to earn staking rewards.

Reddcoin (RDD) – Score: 3.0

Reddcoin was launched in 2014 to become the digital currency of social media.

Reddcoin allows Reddit and Twitter users to tip content creators in digital currency if they like their content. Moreover, Reddcoin holders can stake their coins to receive up to 5 percent “interest” per annum thanks to Reddcoin’s PoS consensus algorithm.

NAVCoin (NAV) – Score: 2.5

NAVCoin was launched in 2014 to add privacy to digital currency transactions. Through its dual blockchain system, NAVCoin users can make anonymous financial transactions on the NavTech subchain. It uses PoS and is based on Bitcoin’s core code. Moreover, NAVCoin holders can earn up to 5 percent “dividend” per annum for staking their coins and there is no cap on staking.

Neblio (NEBL) – Score: 2.5

Neblio is a distributed computing platform for enterprise blockchain applications and services that was launched in 2017. NEBL holders can receive up to a 10 percent “dividend” per annum by staking their coins thanks to the Neblio network’s proof of stake protocol.

BitMax (BTMX) – Score: 2.5

BitMax is a Singapore-based exchange established in 2018. BitMax shares 80% of net transaction revenues with investors in its BitMax token, offering one of the highest payout rates among comparable exchanges. By locking your BTMX token, you become eligible to earn income in USDT.

While the APR will vary based on the exchange’s results, past rates have reached the 35-50% range. BitMax pays “dividends” daily based on the number of tokens held by an investor.

Related Articles:

- Bitcoin Investing 101: What is Bitcoin? How Does it Work? How Can You Invest in It?

- Blockchain Investing 101: How to Build Long-Term Wealth in the Digital Asset Markets

- DeFi Investing 101: What Is It? Where Do You Start? What Are the Risks?

Subscribe to Bitcoin Market Journal for daily updates on the global digital asset markets.