The discussion of publicly traded bitcoin ETFs has been on and off the burner for the fast few years. Even since the launch of regulated bitcoin futures contracts on the CME and CBOE in 2018 and 2019, not a single bitcoin ETF has been approved in the United States.

In the U.S., the SEC has blocked several bitcoin ETF proposals and considering that this form of ETF is thought of as the “holy grail” for institutional investor acceptance, it has yet to come to fruition. There are currently two ETF proposals in the U.S.-pipeline, namely from Kryptoin Investment Advisors and the USCF Crescent Crypto Fund.

What Is a Bitcoin ETF?

An exchange-traded fund, commonly known as an ETF, is a type of investment fund that tracks the price of an underlying asset, such as gold, oil, an index, or a basket of stocks.

It is traded on exchanges in the same way as stocks. That means that any investors – retail or institutional – can buy and sell holdings in an ETF to other market participants over the stock exchange.

ETFs are usually cheaper than mutual funds as they are usually set up as passive index-tracking funds, and they allow investors – even private investors – to gain access to asset classes and niche markets in which it would otherwise be difficult to invest.

A Bitcoin ETF, such as the one proposed by the Winklevoss twins, would have the digital currency bitcoin as an underlying asset. That means that by purchasing a bitcoin ETF, an investor would be indirectly purchasing bitcoin, as he or she would be holding the bitcoin ETF in a portfolio as opposed to the actual digital currency itself. However, as the ETF would closely track the price of bitcoin, for the investor it should make little difference whether he or she is holding a bitcoin ETF or the actual digital currency.

The main difference between buying a bitcoin ETF versus bitcoin itself would be that investors would be purchasing a regulated investment vehicle that they can buy and sell on exchanges instead of having to buy and securely store bitcoin.

How to Invest in a Bitcoin ETF

While there is currently no investable bitcoin ETF on U.S. exchanges, there are exchange-traded bitcoin financial products available on European exchanges and an over-the-counter Bitcoin Trust in which investors can invest.

VanEck

New York-headquartered investment firm VanEck listed a bitcoin ETN in November 2020. The VanEck Vectors Bitcoin ETN (VBTC) can be purchased on the Deutsche Böerse Xetra, which states that investors will benefit from central clearing, which reduces risks in the settlement of transactions.

Investors are charged two percent in ongoing fees.

The Bitcoin Investment Trust from Grayscale

Grayscale Investments’ Bitcoin Investment Trust was launched in 2013 to provide accredited investors with the opportunity to purchase bitcoin in the form of a regulated investment vehicle. Investors can purchase shares in the over-the-counter traded investment fund that holds bitcoin as an underlying asset on behalf of its shareholders.

Investors are charged a two percent annual management fee for holding shares in the Bitcoin Investment Trust.

XBT Provider ETN

The Bitcoin ETNs (exchange-traded notes) by XBT Provider can be bought and sold on the Nasdaq Stockholm stock exchange in euros or Swedish krona since 2015. They enable both retail and institutional investors to gain regulated exposure to bitcoin and, since October 2017, also to Ether (ETH).

Investors are charged a 2.5 percent annual management fee for holding the Bitcoin One Trackers.

Blockchain ETFs

Moreover, there are also a number of blockchain ETFs that invest in blockchain stocks on behalf of their investors. Currently, there are around half a dozen blockchain ETFs in the market including the Amplify Transformational Data Sharing ETF (NYSEARCA: BLOK) and the Innovation Shares NextGen Protocol ETF (NYSEARCA: KOIN).

Canadian Regulators Approve North America’s First Bitcoin ETF

While American investors will still have to wait for a digital currency ETF that trades on a US exchange, Canada approved North America’s first Bitcoin ETF in February 2021.

The Purpose Bitcoin ETF (BTCC) trades on the Toronto Stock Exchange (TSX) and is available in $CAD (FX hedged and unhedged) and in $USD (unhedged).

Investors can buy shares in the fund, which, in turn, then buys “physical” bitcoin and stores it in cold storage. Purpose Investments collects a 1.5% Management Expense Ratio (MER) to manage the fund.

In the first week of trading, the new exchange-traded fund managed to attract over $590 million in assets under management.

While US institutional investors are able to invest in Canada’s first Bitcoin ETF, most US brokerages do not allow retail traders to buy ETFs from overseas exchanges. So, it looks like private investors in the US will have to continue to wait.

The Benefits of an ETF for Bitcoin as an Asset Class

As noted earlier, many investors agree that an ETF is the holy grail for bitcoin as an asset class. Accessible ways to purchase a bitcoin ETF could bring in several types of investors with deeper pockets than most, especially ones that were unable to invest in bitcoin, such as mutual funds and pension funds.

The approval of a publicly-traded bitcoin ETF would also very likely boost the price of bitcoin to new highs as the institutional investors, as well as private investors who are not very versed in technology, would now be able to freely invest in the digital currency through the ETF.

That’s what happened in the early 2000s when the ETF market opened up gold investing to private investors and the price of gold subsequently experienced a tremendous rally that peaked in 2011.

A similar scenario would be expected to happen to bitcoin, where new highs, well above its most recent all-time high in 2020, would be highly likely. Given the strong demand for the high returns that bitcoin could potentially offer, this would be likely.

Can Bitcoin Futures Pave the Way for Bitcoin ETFs?

With the regulatory approval of the CFTC to list bitcoin futures contracts on the CME and CBOE, the door has been pulled wide open for potential bitcoin ETFs in the future.

This is the case not only because a major U.S. financial regulator has approved bitcoin-based financial products, but also because this opens up the opportunity to base a bitcoin ETF on bitcoin futures, which are standardized, publicly traded, and transparent. This would address some of the issues that the SEC currently has with the listing of a bitcoin ETF based on “physical” bitcoin as the underlying asset.

In fact, the SEC had already received several bitcoin ETF proposals that use bitcoin futures as the underlying asset since the launch of bitcoin futures on the CME and CBOE. However, all of these applications were withdrawn after Blass’ staff letter on cryptocurrency ETFs was released on January 18, 2018.

The Bitcoin ETF Saga Continues but with ‘Crypto Mum’ on Our Side

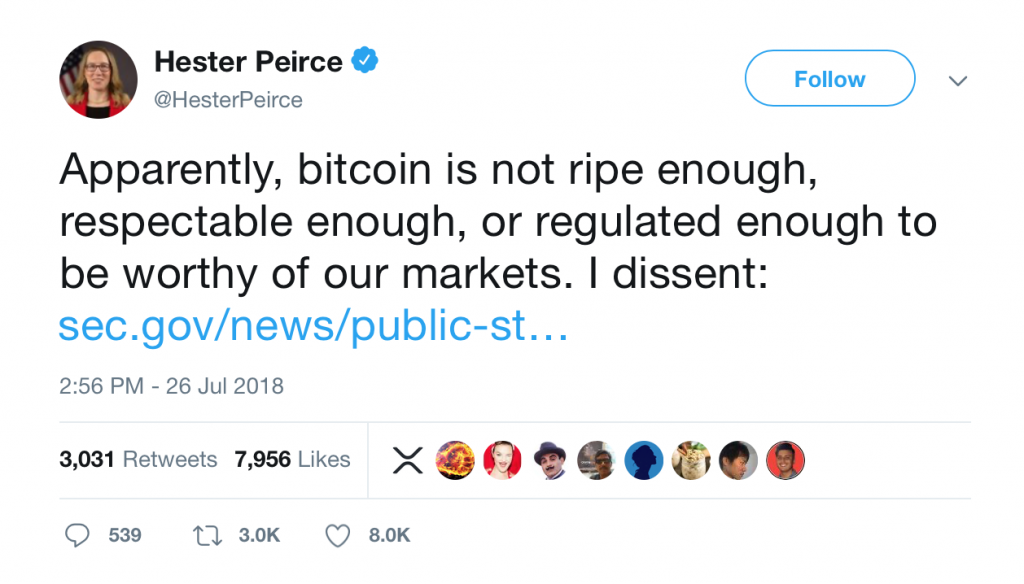

After the SEC Commission did not approve the listing of the long-awaited Winklevoss Bitcoin Trust in mid-2018, SEC Commissioner Hester Peirce, which has since been dubbed ‘Crypto Mum’, published a letter of dissent stating that she believes that the market is ready for a Bitcoin ETF and that she does not agree with her colleagues on the disapproval of the Bitcoin ETF in question.

With Commissioner Peirce now on its side, the cryptocurrency community is more confident than ever that there will be a Bitcoin ETF on US exchanges in the near future. However, the SEC’s concerns around the potential for market abuse due to the lack of oversight of the bitcoin trading ecosystem stands in the way of a Bitcoin ETF approval.

As the bitcoin market matures and the transparency surrounding its trading activities increases as well as the security measures of leading digital currency exchanges, it is not far-fetched to assume that a bitcoin ETF will eventually become listed on a major U.S. stock exchange.

Related Articles:

- What Would a Bitcoin ETF Mean for the Crypto Market?

- How to Invest in a Bitcoin ETF

- How Many People Use Bitcoin in 2021?

If you want to stay informed about future regulatory developments surrounding bitcoin and digital currencies, subscribe to the Bitcoin Market Journal newsletter today.