Interest in investing in digital assets continues to grow. But new investors are often confused about how to value this new type of digital-only asset.

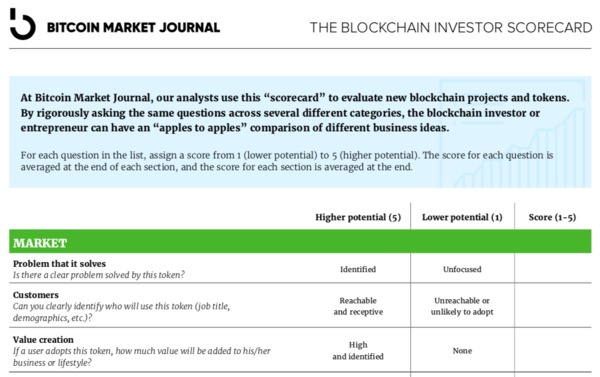

To address this investor challenge, Bitcoin Market Journal has developed an analysis tool called the Blockchain Investor Scorecard (You can download it at the bottom of the article!).

Based on the input of BMJ’s knowledgeable analysts and experts, this scorecard creates an industry standard for “apples-to-apples” (or ice cream cone to ice cream cone) comparison of token offerings in clear, concise language.

In this article, you will learn how you can value a digital asset using the Blockchain Investor Scorecard.

How the Blockchain Investor Scorecard Works

The Blockchain Investor Scorecard uses five criteria to help quantify an investment opportunity. They are as follows:

Market

As with any asset, its viability has to be supported by a market that needs it. Otherwise, it could be just another concept that disappears in obscurity. The market also has to have be mature enough to support a new token.

Here are some questions that are considered when evaluating the market:

- Does the token help solve a clear problem?

- Is the target customer clearly identified? If so, is this customer likely to adopt the token, or are they unreceptive?

- If someone decides to invest in this token, how much value will be added to their business or lifestyle?

- Does the token serve a market that is emerging or fragmented, or is the market centralized and mature?

- How big is the market?

- Does the size of the market support investment in the token?

- Is it likely that this token is going to be affected by regulations?

Competitive Advantage

Competition is healthy, but if the competition has too much of an advantage, a token can lose relevancy. Also, to combat competition, the team needs to have the right contacts in place, so it can use them to navigate the tricky process of adoption.

Some questions that address competitive advantage include:

- Is the token built on a standard blockchain that is well-known, or is it built from the ground up on a new blockchain?

- Does the team behind the token have a time advantage over other companies who are developing a similar idea?

- Does the team have a network of key players it can use to gain a market advantage or is its network limited?

Management Team

The team behind the token is as important as the token itself. They need to have more than just a cool idea. They need to have the knowledge and experience to support an offering as novel as a digital token. They also have to have a track record of honest, upstanding business practices.

Here are some questions the scorecard asks regarding the management team:

- Does the team behind the token have a track record of success, or is the team weak or under-supported?

- Does the team have adequate technical or industry experience, or are they new to the game?

- Do they have a track record to demonstrate this experience?

- Is the team known for dealing honestly and transparently, or do they have questionable dealings with others, showing a lack of integrity?

Token Mechanics

The way the token works will be another crucial component of its success or failure. It will not add real value if it addresses a problem for which no token is necessary. It also has to be decentralized in order to prevent becoming another tool for the broken economic system that the blockchain was designed to address.

Further, the supply of the token – both now and in the future – needs to be transparent. Otherwise, dilution could result. Where the token will be exchanged is another critical factor because where it is exchanged will affect how users view its legitimacy.

Some of the questions the scorecard asks about the token’s mechanics include:

- Does the problem it addresses really need a token to help solve it, or can it be solved without the use of a token?

- Does the token create new, tangible value, or is it essentially a copy of another concept?

- Is it a decentralized asset where users do the work, or is the work done by a company?

- How is the supply of it?

- Is there an established amount of tokens available now?

- Can more be added in the future? And is the amount that can be added relatively certain, or can an unknown amount be added that could serve to dilute the token’s value?

- Which digital exchanges will be listing it? Are they well-known and reputable?

- Is there a minimum viable product available (MVP), or is the token conceptual at this point?

User Adoption

At the end of the day, it’s all about the user. To be viable, a token needs to be user-friendly and respected by everyday people.

- Will it be easy for a non-technical user to understand how to use the token, or would a user need to be technically savvy?

- Is it associated with brands and institutions with strong reputations?

- Are people talking about it, or is it still relatively unknown?

While it’s impossible to foresee the future of any digital asset, with the standards set forth in the Blockchain Investor Scorecard, investors can gain insights into the foundation underneath a token. The scorecard incorporates a balance of evaluation tools, which helps prevent the final assessment from being skewed too far in one direction or another.

To get your free copy of the Bitcoin Market Journal Blockchain Investor Scorecard and Early Investor Scorecard, simply fill out the form below for immediate access!

Related Articles:

- How to Use Token Velocity to Value Digital Assets (With Downloadable Spreadsheet)

- How to Use the Network Value-to-Transaction (NVT) Ratio to Value Digital Assets (With Downloadable Spreadsheet)

- How to Use the Network Value-to-Metcalfe (NVM) Ratio to Value Digital Assets

Subscribe to Bitcoin Market Journal to gain insights into the latest trends and developments in the digital asset markets.