Bitcoin has “digital scarcity” because its total coin supply is limited to a maximum of 21 million coins. The concept of digital scarcity that has been pioneered by Bitcoin has expanded to include so-called crypto collectibles. Unlike Bitcoin, crypto collectible tokens are each unique in their own way and can represent value beyond the digital world.

In this guide, you will learn about all essential aspects of crypto collectibles so that you can decide for yourself whether you want to invest in this new esoteric digital asset class.

In a Nutshell

The key difference between non-fungible tokens and cryptocurrencies is fungibility. Fungibility refers to the interchangeability of an asset. For example, bitcoin is fungible because each individual unit is interchangeable and essentially identical to the others, which is imperative for an asset that hopes to operate as a medium of exchange. In contrast, crypto collectibles are digital assets with unique identifiers that separate them from all other units. The unique identifier could refer to a physical object or a tokenized version of the asset. The most common framework for non-fungible tokens are ERC-721 token that are issued and traded on the Ethereum blockchain. Thousands of people trade non-fungible tokens on marketplaces like OpenSea, which connect buyers and sellers of these new type of digital tokens.

What are Crypto Collectibles?

In the US, you can find millions of collectible enthusiasts ranging from baseball card fanatics to keychain lovers. Blockchain technology has opened the doors for the world of collectibles into the digital realm to allow millions of people around to connect and trade collectibles with each other.

The first crypto collectible token to burst on the scene was CryptoKitties, a project launched in late 2017. The idea was simple, create non-fungible tokens that represented digital kittens each with their own unique characteristics such as eye/fur color, size, name, personality, etc. Moreover, each kitten “lived” on the blockchain and the transfer of a kitten from one person to another could be transparently viewed on a public blockchain ledger so there was no chance for duplication or the creation of a “fake” cryptokitty.

The first crypto collectible token to burst on the scene was CryptoKitties, a project launched in late 2017. The idea was simple, create non-fungible tokens that represented digital kittens each with their own unique characteristics such as eye/fur color, size, name, personality, etc. Moreover, each kitten “lived” on the blockchain and the transfer of a kitten from one person to another could be transparently viewed on a public blockchain ledger so there was no chance for duplication or the creation of a “fake” cryptokitty.

The popularity of CryptoKitties when it fist launched led to a blockage on the Ethereum network due to the collectible game’s surge in users. Players wanted to collect the “best and rarest” virtual kittens so much that the community created an auction board where users could bid on their favorite kittens. Some digital kittens ended up selling for over $100,000!

We know that this non-fungible model works as it has existed in the video game industry for quite some time. For example, Fortnite – one of the most popular video games of the past decade – lets users customize their characters with different “skins”. The skins are essentially different costumes and outfits for the character, providing the player with a sense of identity and uniqueness.

However, the different between traditional in-game tokens and non-fungible blockchain-based tokens is that the owner of the latter has actually ownership and complete control over his token. Conversely, in the former, the game developers own the token and the gamer can only access it provided the centralized authority behind the game allows him or her.

Wait there’s more!

Non-fungible tokens not only represent opportunity in the world of collectibles, but they’re also great mediums for tokenizing real world assets. Users can specially create tokens with metadata that allows others to track the ownership of the token. This enables interested buyers to instantly ensure the authenticity of the asset or collectible before purchasing it.

Therefore, investors and buyers alike can rest easy knowing their purchase is legitimate. Moreover, since crypto collectibles “live” on the blockchain, you can view the transfer of ownership in a transparent manner and only the current owner has access to the collectible item.

Should You Invest in Crypto Collectibles?

Crypto collectibles are still at an early stage in the development of its market. Today, most of these type of digital tokens mostly consist of online games that offer in-game non-fungible tokens. However, there are already startups out there that are tokenizing real-world collectibles to enable anyone around the world to hold the rights to these assets in digital form.

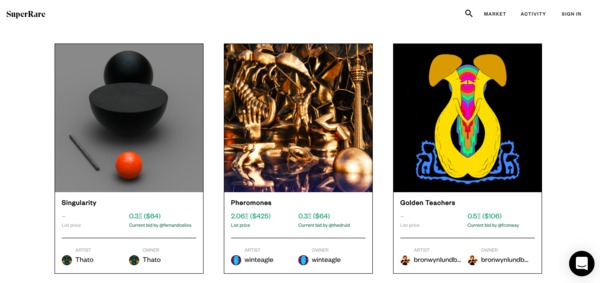

The platform SuperRare, for example, allow users to invest in non-fungible digital art tokens or tokenize pieces of art that they’ve created. This is a sign that there will become to come in terms of the tokenization of real-world collectibles!

Tokenizing real-world assets requires more due diligence than that of digital-only digital assets, so the crypto collectibles market still has a ways to go before mass trading of crypto collectibles is possible. But as it stands, it looks like adding alternative assets – such as art or super cars – into your portfolio will be as easy as buying a digital token online.

Top Crypto Collectible Tokens Marketplaces

The market for crypto collectibles is still in its infancy as this is an entirely new type of asset. The industry remains relatively untapped, ripe for innovation and new platforms to wow the current users and attract new ones.

Currently, the most popular platform in terms of volume and customer base is OpenSea. It markets itself as the largest digital marketplace for crypto collectibles, including the new ERC-721 and ERC-155 non-fungible tokens. However, there are also other marketplaces you can check out if you want to take a look at what you can already purchase in this new asset class.

[table id=212 /]

The Bottom Line

The value proposition of non-fungible token is very appealing as the world progresses towards digitization. Technology has transformed the world through digital applications, and now we can represent physical assets as digital ones as well. Using non-fungible tokens to represent unique assets allows users to buy, sell, and invest in these collectible assets at the click of a button.

Furthermore, certain non-fungible tokens can present metadata about an asset that would otherwise not exist or be withheld by the owner. A marketplace of crypto collectibles can now exist as a trustless platform where authenticated users can buy, sell, and trade their authenticated digital assets.

Related Articles:

- Digital Assets Ranking & Analysis

- How to Diversify Your Digital Asset Portfolio (+ Example Portfolios)

- How to Value Digital Assets Using the Blockchain Investor Scorecard

To stay up-to-date with the latest developments in the digital asset markets, sign up to Bitcoin Market Journal’s Blockchain Investor Daily today!