Many investors yearn for the ‘S’ word in their digital assets investments: stability. Well, it’s no longer just a yearning ever since stablecoins emerged. Investors who were previously pushed away due to the volatile nature of digital assets re-gained their interest, no pun intended.

One of the reasons stablecoins caught the eye of many investors was of course the higher interest offered on compared to traditional banks.

Investors can earn higher interests offered on stablecoins through CeFi platforms like Nexo or DeFi platforms like Aave.

Stablecoins almost act like a seatbelt for investors in the fast-paced and volatile world of digital assets. This is why it is a popular avenue for new investors who want to be a part of the digital assets world.

Why?

Stablecoins offer some degree of immunity to huge fluctuations, typical for tokens like ETH, BNB, or UNI.

What Are Stablecoins?

A stablecoin is a type of cryptocurrency that links its value to an asset such as the U.S dollar whose value does not change much. Stablecoins could also be linked to commodities like gold.

Stablecoins offer the best of both worlds: the security and instant processing characteristics of digital currencies and the stability offered by fiat currencies like the U.S dollar.

Now that we have a better idea of what stablecoins are all about let’s see where and how you can start benefitting.

Earn Stablecoin Yield in CeFi: Here’s Where & How

In the CeFi space, Nexo is one of the most popular platforms with high interest rates. One of the reasons Nexo is so popular is that it also allows its customers to earn interest on fiat. You can, therefore, earn 10% interest on USD, GBP, and EUR. This could go up to 12% if you choose to accept payment in NEXO, its native platform token.

As for stablecoins, Nexo offers interest rates from 8-12% depending on your ‘loyalty level’. This is determined by the ratio of NEXO tokens to other digital assets in your account.

Let’s take a practical example to see exactly what these numbers mean for your investments. Say you convert $2,000 to a stablecoin like Tether USD and leave it in your Nexo account for a year, the amount would accumulate to will amount to $2,200, assuming a 10% interest.

How to Get Started with Nexo And Start Earning

You can follow these simple steps to get started with Nexo.

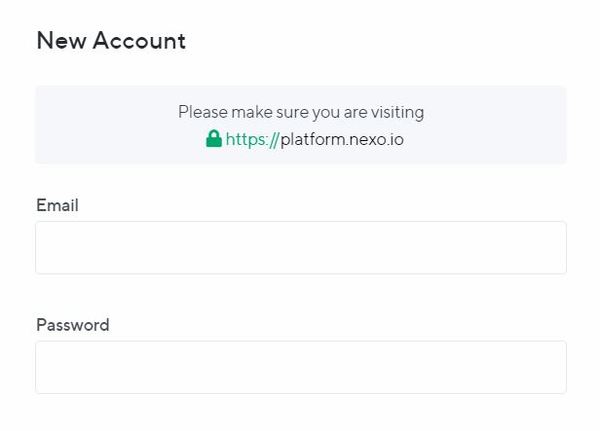

- Visit nexo.io to create a new account. Make sure you choose a strong password.

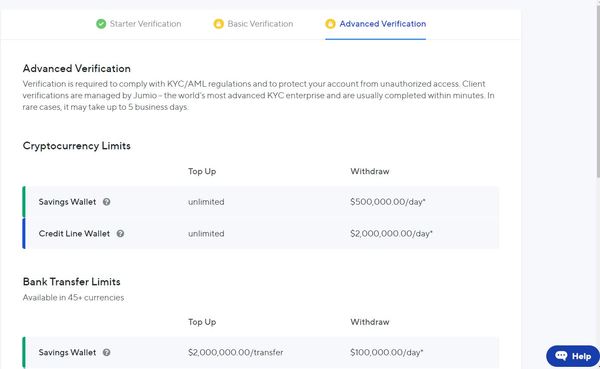

2. Click the profile icon at the top right, and choose ‘my profile’ to pass KYC.

- The basic KYC allows you to earn interest on all supported stablecoins and cryptocurrencies.

- The advanced KYC on the other hand allows you to also earn interest on fiat currencies.

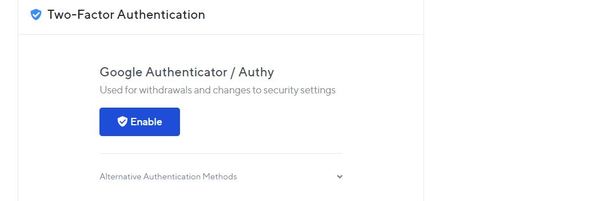

- Next, click on the profile icon and select ‘security.’ At the bottom of the page, you will have an option to activate two-factor authorization for additional security. For this, you can either download the Google Authenticator app or Authy on your smartphone then, click ‘Enable’ and scan the QR code provided.

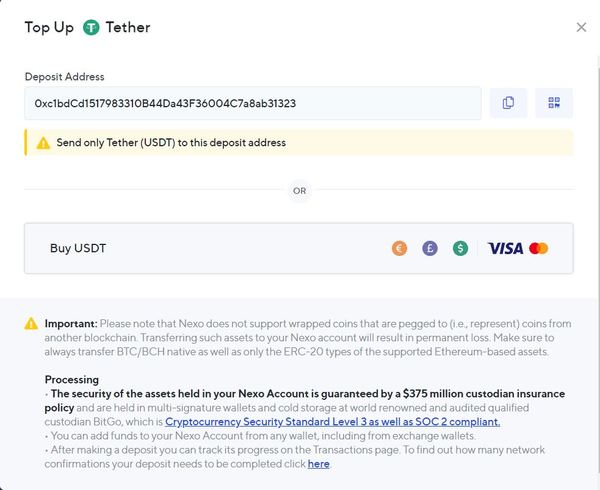

- Once you pass your KYC click on the ‘Account’ button at the top menu and pick the stablecoin you want to deposit. You can transfer your assets in two ways:

- Top up your account with crypto either from an exchange or your wallet.

- Transfer USD, EUR, or GBP directly from your bank.

- After buying a stablecoin of your choice, you will start earning interest the next day. Your interest is compounded daily and automatically paid to your savings wallet.

You can withdraw your funds whenever you like without losing accrued interest. Additionally, you can top up your savings wallet without any fees.

Earn Stablecoin Yield in DeFi: Here’s Where & How

DeFi lending platforms also allow investors to earn interest at competitive rates through a decentralized application system. Unlike CeFi platforms, you don’t have to complete any KYC to enjoy their services.

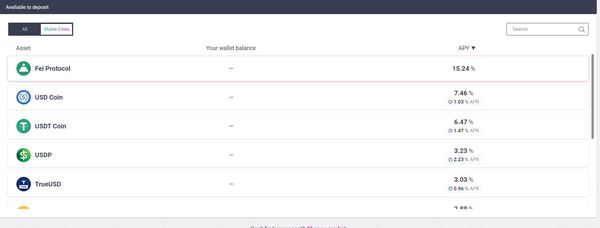

That said, Aave is one of the most popular platforms in the lending space. Aave offers up to 7.46% interest on stablecoins like USD Coin, around 4.69% interest on DAI, and up to 6.47% on Tether (USDT).

How to Get Started with Aave And Start Earning

Getting started with Aave is simple.

- First, visit Aave.com

- Next press the ‘Enter app’ button to access their platform.

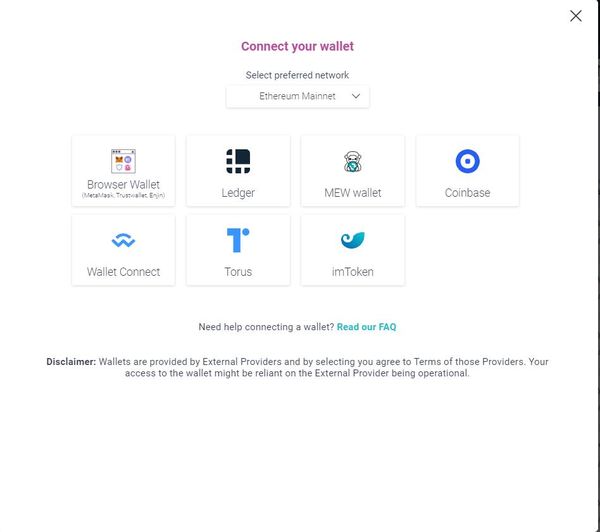

- Navigate to the ‘connect’ button at the top right corner to connect your wallet. Pick your wallet from the list.

- After connecting your wallet, choose the ‘Deposit’ option in the top menu. On the left of your screen, Toggle ‘All’ to ‘Stablecoins’ to view available stablecoins.

- Pick a stablecoin and deposit it to your account and you are good to go!

What sets DeFi apps like Aave apart from CeFi lending platforms is that they’re non-custodial. That means that your deposits are in your control.

Whether you consider going with the CeFi or DeFi option, stablecoins currently offer above-average interest, up to 10 times higher than what is offered by banks.

Related Articles:

- Bitcoin Investing 101: What is Bitcoin? How Does it Work? How Can You Invest in It?

- Blockchain Investing 101: How to Build Long-Term Wealth in the Digital Asset Markets

- DeFi Investing 101: What Is It? Where Do You Start? What Are the Risks?

To learn more about stablecoins and other exciting digital assets investment opportunities Subscribe to Bitcoin Market Journal today!