This is a followup to our top-rated How to Invest in DeFi article. Here’s the TL;DR version:

- Instead of putting your money into all these DeFi platforms, just buy the tokens instead (e.g., instead of locking up value in Compound, just buy and hold COMP)

- The tokens can be considered like “stock” in these “companies” (e.g., buying UNI is like buying “stock” in the Uniswap “company”)

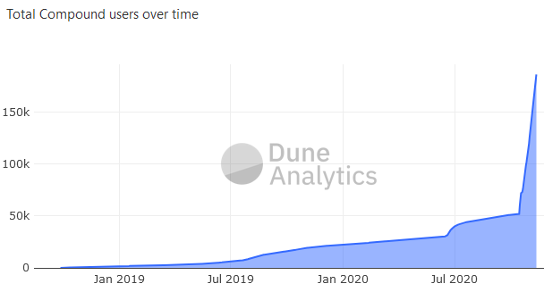

- To quickly validate which tokens might be a good buy, look at user growth (chart here)

- Any projects that are rapidly growing (but token price is not) are likely good buys

- As always, do additional research, and don’t invest more than you’re ready to lose

Once you’ve identified a good DeFi investment, here’s the 3-step method to invest in these tokens:

- Buy Ethereum (using a service like Coinbase)

- Transfer your ETH to a MetaMask wallet

- Swap your ETH for a new token (instructions here)

I’ve tested this approach with some of the smartest investors and traders in DeFi, inviting them to poke holes in it (I invite you to poke holes in it, too). They have agreed this is a good approach for long-term investors in this space. In my mind, it’s like buying GOOG stock in 2004.

Today I want to add a little more nuance to this approach, to help you find good long-term DeFi buys. And it starts with something I heard from an insider at Binance.

Blockchain is Transparent

DeFi is built on public blockchains, which means you can see everything happening, in real time.

This is a huge difference from investing in public companies. Let’s say you hold FB stock: you know the number of people using Facebook is an incredibly important factor in the value of your investment. But you don’t know how many people are using Facebook until they release their quarterly reports, by which time the data is old.

In blockchain (where user growth is everything), you can see this data real-time. (Again, here’s the chart.) Because blockchains have network effects, rapidly growing blockchains can have quadratic growth curves. Check out for instance this growth in DeFi protocol Compound:

This kind of data is the blockchain investor’s secret weapon. It’s just not available to ordinary investors in ordinary markets: it shows you how many people are actually using a blockchain, not just hyping it.

Public blockchains are transparent. This is not theory: it’s a fact. And it’s staring you in the face.

I recently attended the Harvard Blockchain Club Meetup, where they had on Flora Sun from Binance X, which is the innovation arm of Binance (think Google X). She talked about Binance Smart Chain, which is Binance’s new blockchain for building DeFi projects (their answer to Ethereum, which is where practically all DeFi projects are built today).

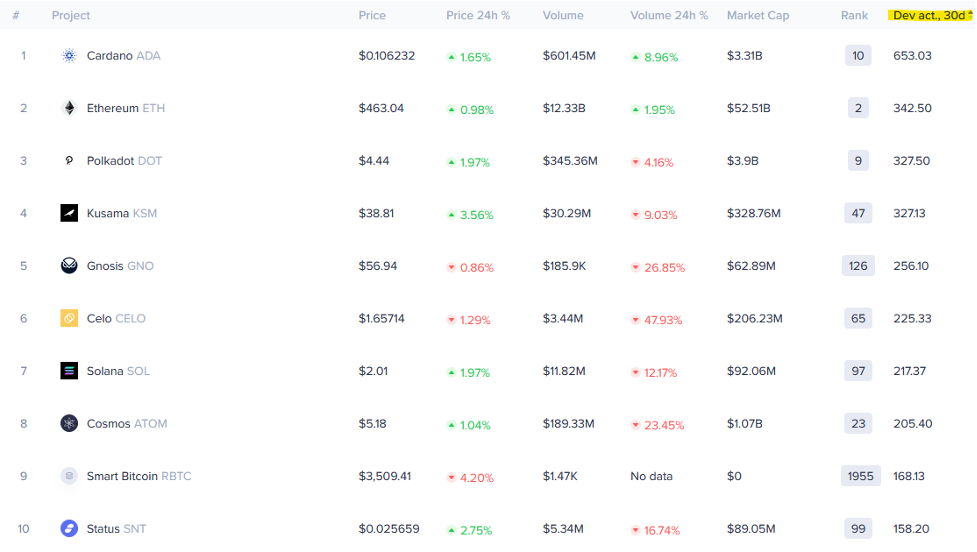

She pointed out that one of the key metrics they use for the success of Binance Smart Chain is how many developers are building things on it. This was a lightbulb-switch, key-click, “a-ha moment” for me.

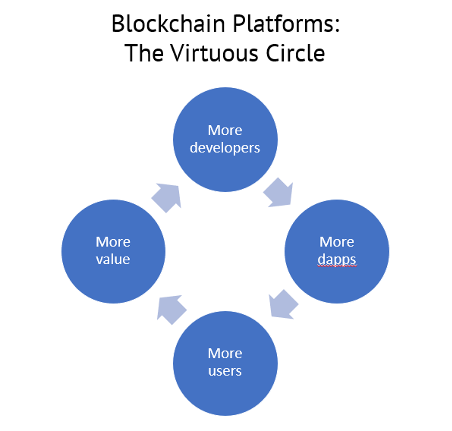

Think about this logically: when you have more developers on a DeFi blockchain, you have more dapps being released. Dapps attract users. More users, in turn, attract more developers. In the best case, you have a virtuous circle that we look for as investors:

This is why the easiest way to invest in DeFi is simply to buy and hold Ethereum. ETH is the main game in town, the blockchain that all these dapps are being built upon. It’s like investing in FB stock (the platform) instead of ZNGA (an app distributed on that platform).

Thus, “number of developers” is a good metric for measuring the value of blockchain platforms, like Ethereum, Cardano, Polkadot, and Binance Smart Chain.

Note this doesn’t work for DeFi protocols, just DeFi platforms. But there is a similar metric for DeFi protocols: POWER USERS.

Measuring Power Users with Discord

For example, Discord is the instant messaging platform of choice for the crypto community. (I’m not a fan, but my kids love it.) Discord is geeky and difficult to use – think early Usenet newsgroups – which makes it a good “barrier to entry” to measure power users of a DeFi protocol.

[table id=229 /]

Why Discord? Why not Telegram, Reddit, and Twitter?

First, there’s the problem of counting the same user multiple times: if you’re a “power user” on Discord, you’re probably also on Twitter, so let’s keep it simple and just use one channel.

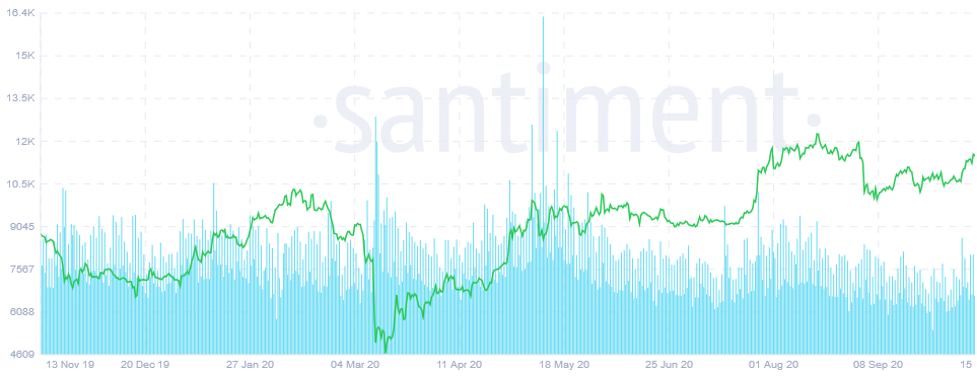

Twitter is also a different animal: It’s easy for anyone to tweet about anything; it’s much harder to find and join a Discord server. Plus, Twitter activity pretty much just matches price movements, so it doesn’t tell you anything useful about where or when to invest:

In the chart above, the green line is bitcoin price; blue spikes are social activity around “bitcoin.” I’m hard-pressed to see a pattern, except that social activity spikes when bitcoin price spikes. Twitter activity, in other words, is not very useful for valuing a blockchain.

Think of it this way: Twitter is low commitment. Discord is higher commitment. Using the platform is very high commitment. Buying the token is the highest commitment.

Putting it Together

In summary, we can value the leading DeFi protocols by adding up their active users (most important) and power users (secondary importance) to get a rough “value per user.”

[table id=230 /]

Looking at these numbers, we’d say that Uniswap may be somewhat undervalued, while Ren and Aave seem to be overvalued. While no one knows what a blockchain user “should” be worth, this early data would suggest something like $2,000 per user. The chart makes it even more clear:

This doesn’t tell us everything, but it tells us a lot – especially when tracked over time. Because of blockchain’s network effects, when we see total users and power users skyrocketing (without a subsequent increase in price), we’ve potentially got a hit on our hands.

In summary:

- Look at total users and power users to see which DeFi projects are experiencing “rocket ship” growth.

- Look for where the token price is low, relative to the user growth.

- Do your qualitative research, in addition to this quantitative research (use our Blockchain Investor’s Scorecard).

- When you are satisfied, simply invest in the underlying token, which is like buying “stock” in the “company.”

These numbers are the blockchain investor’s secret weapon. And because this space is so new, it’s like we’re solving the Da Vinci Code before Robert Langdon gets out of bed. It’s a long-term play, but we’re long-term investors.

It’s like buying GOOG stock in 2004.

For more investing insight, don’t forget to sign up for our free weekly blockchain investing newsletter.