_600x.jpg)

While the majority of the bitcoin community firmly believes that the value of the world’s leading digital currency will continue to increase as it has historically, you may disagree. If you think that bitcoin is overhyped and overpriced, you can short the digital currency using a variety of methods.

In this guide, we describe five popular options for shorting bitcoin in 2019.

Short Selling on Digital Asset Exchanges

Perhaps the simplest way to short bitcoin (BTC) is to short sell the digital currency on digital asset exchanges. While not all exchanges allow you to short bitcoin, leading exchanges such as Bitfinex, BitMEX, and Kraken provide this feature.

To short sell bitcoin on an exchange, you need to sell the digital currency at the current price level and then buy back the currency at a later point when you want to close out the position. To short sell, you first need to borrow the asset. This happens behind the scenes, but you will need to pay a small borrowing fee for the term of the trade, which exchanges usually automatically deduct from your profit.

Most exchanges that offer short selling also enable traders to use margin so that they can use leverage for their trades to potentially boost their trading profits.

Shorting Bitcoin CFDs

The next best way to short bitcoin – especially for private investors – is to use Bitcoin CFDs. Online CFD brokerages such as FXCM, CMC Markets, and eToro enable traders to buy and sell CFDs (contracts for difference) on stocks, currencies, and commodities without owning the underlying asset. Moreover, CFDs also enable traders to use leverage.

The majority of CFD brokerages also support bitcoin trading. Investors can, therefore, go short bitcoin by selling bitcoin CFDs using leverage. The mechanics of shorting bitcoin using CFDs is effectively the same as on bitcoin exchanges. However, investors who are already trading on online CFD brokers may find it easier and more convenient to short bitcoin on a platform with which they are familiar than to register to a bitcoin exchange.

Sell Bitcoin Futures

Alternatively, investors can also sell BTC futures contracts to short bitcoin. Bitcoin futures can be found in an unregulated format on specialized digital currency derivative trading platforms, such as BitMEX, or in regulated format on the Chicago Mercantile Exchange (CME), a leading US-based derivatives exchange.

Futures are financial derivative contracts that enable an investor to buy or sell an asset (such as bitcoin) at a predefined price at a predetermined date in the future. This enables investors to speculate on the price of an asset without having to buy the underlying asset.

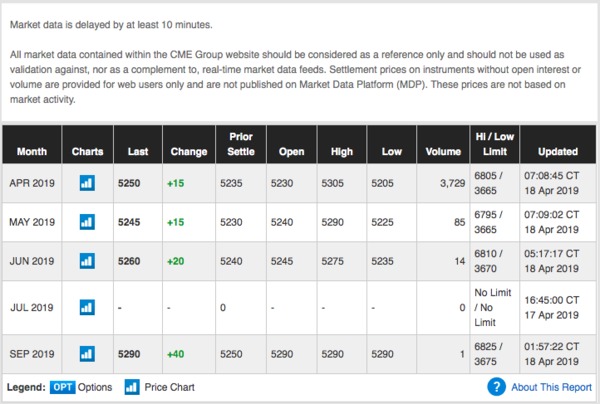

For example, if you want to short bitcoin using futures on the CME (for which you will need a broker that supports CME BTC Futures), you could sell the JUN2019 futures at $5,260 today. Should the price of bitcoin drop to say $4,260 by the expiry date in June, you will have made a profit of $1,000 on your short position (minus trading fees).

Regulated bitcoin futures on the CME (as seen above) are generally traded more by institutional and accredited investors than small private investors.

Buy Bitcoin Put Options

For investors who are comfortable with financial derivatives, bitcoin options would be another method of betting on a price decline of bitcoin. Options give holders the right but not the obligation to buy or sell an asset at a predefined price at a predetermined time in the future.

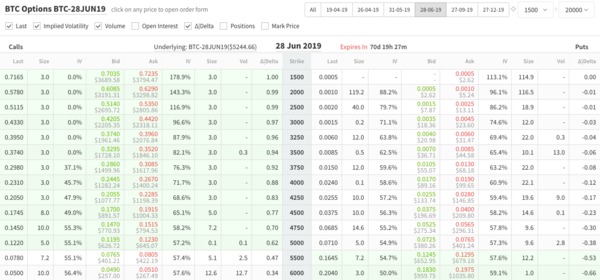

Currently, two of the most popular derivatives trading platforms that support bitcoin options are Deribit and Quedex.

To bet on a bitcoin price decline using options on the Deribit platform, you could buy June 2019 put options with a strike price of $4,250 for BTC 0.0280 ($146.85) per option. Should the price of bitcoin drop below $4,250 dollar by June 28, 2019, you would be “in-the-money,” at which point you could exercise your option to sell bitcoin at $4,250 and buy it in the market for the lower price to close your options trade out with a profit.

Your profit will be the difference between how far in the money your option is minus the premium (the BTC 0.028 fee) you have paid for the put option.

Short Bitcoin on Prediction Markets

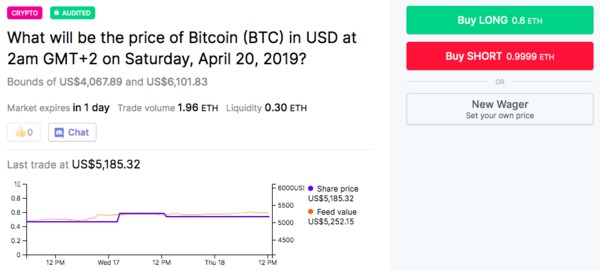

Finally, you could also make use of blockchain-powered predictions markets such as Augur or Veil that enable you to bet on the price development of bitcoin. On these platforms, you can stake digital currency such as ETH on a bet of where the price of bitcoin will trade at a specific time in the future.

For example, on the following bitcoin prediction market on Veil, you could place a bet of 0.9999 ETH (or set your own wager) that the price of bitcoin will drop until the pre-determined time and date. Should you be correct, you will receive a payout in Ether (ETH).

To use prediction markets, you will need to be able to fully understand how the platform works and have a certain level of comfort when it comes to dealing with digital currencies and smart contracts. Hence, this method of shorting is generally for more advanced bitcoin users.

Related Articles:

- How Do Bitcoin Futures Work?

- How to Trade Bitcoin Options in the United States

- Best Cryptocurrencies to Mine with a PC

To learn more about trading, mining, and investing in bitcoin, subscribe to the Bitcoin Market Journal newsletter today.