Executive summary: Bitcoin ordinals bring non-fungible tokens (NFTs) to the bitcoin blockchain. This innovative approach not only enhances the intrinsic value of bitcoin, but also provides long-term investors with fresh opportunities to invest in bitcoin-based NFTs.

Non-fungible tokens (NFTs) have been trending in the crypto investment space since 2021. Primarily hosted on blockchain networks that support smart contracts — Ethereum, Solana, and Binance Chain — NFTs are now poised to make a splash in the bitcoin ecosystem. This has been made possible thanks to Casey Rodarmor’s ingenious bitcoin ordinals protocol.

Bitcoin ordinals assign each satoshi — the smallest fraction of a bitcoin — a unique identifier, turning them into trackable units. Bitcoin ordinals thus keep tabs on each satoshi’s creation and transaction history, effectively transforming them into bitcoin’s very own NFTs, which can contain unique inscriptions such as images, texts, or GIFs.

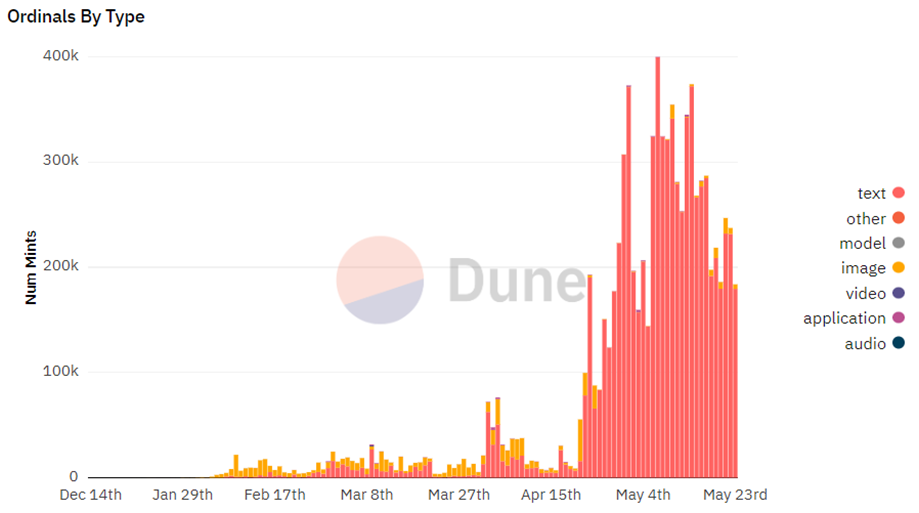

Since its inception in 2023, the system has already minted millions of these ordinal NFTs. The data inscribed in these ordinals remains permanently etched on the bitcoin blockchain, thereby ensuring its decentralization and independence from third-party control.

Bitcoin hardliners have been vocal with their concerns about potential network congestion and a surge in fees. However, the transformative potential of bitcoin ordinals is widely regarded as a significant leap forward in the NFT space.

Just as with NFTs on Ethereum, bitcoin ordinals promise to be a compelling investment proposition. We are already witnessing the creation of some high-profile ordinals, hinting at a promising future value for these distinctive tokens.

What are Some Popular Ordinals?

Shortly after its launch

Shortly after its launch, ordinals witnessed quick success, with individual pieces selling for hundreds of thousands of dollars.

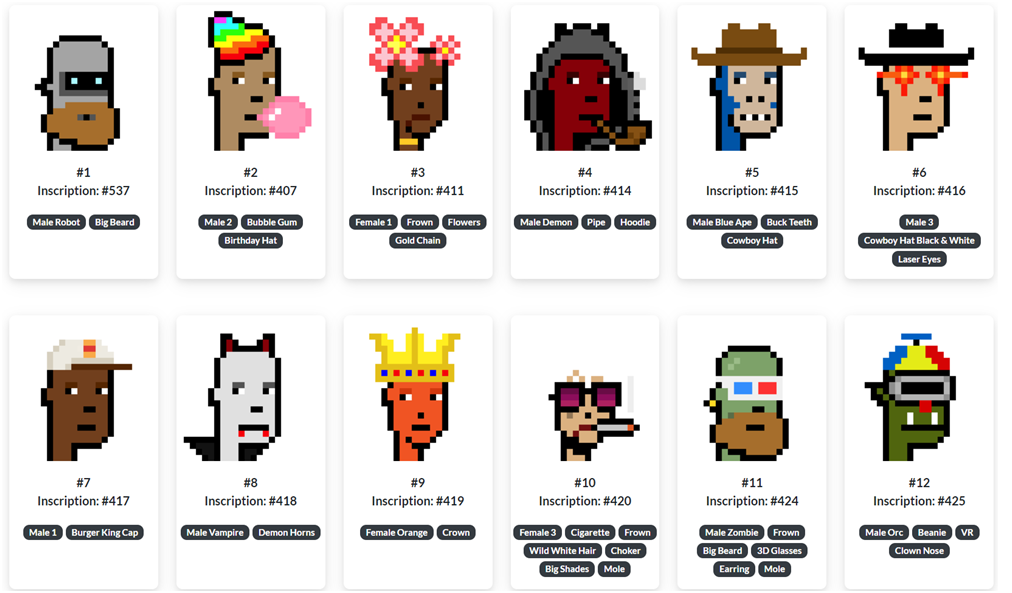

Notable projects include “Ordinal Punks,” a collection of 100 bitcoin NFTs inspired by CryptoPunks, and “Taproot Wizards,” a series of hand-drawn NFT wizards that marked the largest block and transaction in bitcoin’s history at 4MB.

Ethereum-based “OnChainMonkey” minted 10,000 ordinals into a single inscription, demonstrating a scalable model for creating bitcoin NFTs without overloading the network.

Yuga Labs’ 300-piece collection, “TwelveFold,” featured 288 pieces for auction, crafted using 3D modeling and high-end rendering tools, with the remaining 12 reserved for philanthropic endeavors.

Investors looking to get exposure to bitcoin ordinals should consider the potential subjective value of the content and pay attention to the reputation of the collection, team, etc. (Download our NFT Investor Scorecard for a fill-in-the-blank framework for rating NFT investments.)

How Bitcoin Ordinals Work

Launched in January 2023

Launched in January 2023, ordinals allow non-fungible tokens (NFTs) to exist on bitcoin. The goal was to create an indelible presence of digital content, like art, text, or video, on the bitcoin blockchain. crypto wallet

With this system

With this system, each sat associated with a unique inscription becomes an NFT. The protocol has ignited interest within the community, and since its launch, millions of ordinal NFTs have been minted, marking a significant evolution in the nascent bitcoin NFT landscape.

Ordinals are like a tracking system for satoshis, the smallest bit of a Bitcoin. When we put more info on them, they become NFTs. When a satoshi is made during the mining process, it gets its own special number that we can follow during all future bitcoin transactions. crypto whale

To illustrate, if it’s the 1000th satoshi to be made, its special number would be 1000. Since there are only ever going to be 21 million bitcoin, that means we will end up with 2.1 quadrillion of these uniquely numbered satoshis. We can call each one an “ordinal.” fomo

The ordinal system also gives each satoshi another special number based on where it sits in the lineup of all the bitcoin that’s been mined. It also shows where each satoshi stands as a percentage of all bitcoin. On top of all that, each satoshi gets a special letter name. These names get shorter over time, and the very last satoshi will be named “a.”

This is an example of how a satoshi might be labeled using this ordinal system: fiat

Bitcoin ordinals originate from an ongoing debate within the bitcoin community on whether bitcoin should only process financial transactions, or function as a decentralized network for secure data storage. In its early years, bitcoin only allowed messages up to 80 bytes to be encoded onto blocks: barely sufficient to encode short text messages like hashes. Two major hard fork updates, Taproot and Segwit, increased the block size limit to 4MB, introducing a more efficient method of arranging transaction data and opening the door to ordinals.

At the protocol level, these sats remain fungible: they can still be spent just like any other sat. But they are also non-fungible, as these sats carry an additional piece of information (the ordinal).

A familiar example would be to compare ordinals with dollar bills. While each one-dollar banknote is fungible and has an identical value to any other one-dollar bill, it has a unique serial number that differentiates it from the rest of the banknotes. token

How Ordinal Inscriptions Work

Ordinals act as the underlying infrastructure and are the first part of a so-called bitcoin NFT, with the second one being the content itself or the inscription. In the example with the dollar bill, it would be like an autograph inscribed on the banknote.

Ordinal inscriptions can be images, text, or GIFs linked to individual sats. This process is facilitated using the ord open-source software in combination with a bitcoin node.

Given that ordinals are confirmed and recorded on the bitcoin blockchain, the inscribed content is permanent, unalterable, and bitcoin-native. Unlike most existing NFTs that rely on off-chain storage, inscriptions are completely on-chain, making them decentralized and not subject to third-party control.

Note that the ordinals protocol doesn’t modify the bitcoin blockchain or create a separate layer. However, it does benefit from the Taproot upgrade, which improves transaction privacy and efficiency.

The inscribed content is stored in the witness section of a bitcoin transaction, an area made available by the SegWit upgrade implemented in 2017. Later, Taproot further enhanced this by removing data storage limits within blocks, allowing inscriptions of almost 4 MB in size.

How Ordinals Differ from NFTs

The introduction of ordinals has opened the door for bitcoin NFTs, although the term is not really accurate. This is because bitcoin ordinals and traditional NFTs are fundamentally different.

An NFT is a distinct entity from the native cryptocurrency of the blockchain that hosts them. For example, an Ethereum-based NFT is entirely different from an ETH token, and the protocol treats them as such. NFTs have their own standard on Ethereum, which is why NFTs cannot be confused with regular tokens.

Elsewhere, the bitcoin protocol doesn’t natively recognize bitcoin ordinals, and they can effectively exist as either fungible or non-fungible units. That ultimately depends on the preference and recognition of satoshi owners and bitcoin users. For the bitcoin protocol, a satoshi with an inscribed digital artifact can be treated like any other satoshi if the user does not value or recognize the inscription. This is not possible with Ethereum NFTs, where uniqueness and non-fungibility are enforced at the protocol level.

Back to our banknote example, a one-dollar bill with an autograph is still recognized as one dollar by the bank, but it can be sold for higher amounts to collectors that value the autograph. Traditional NFTs don’t have this fluidity.

Another major difference is that bitcoin ordinals are stored directly on-chain and unable to censor, while NFTs are often associated with off-chain data on the Interplanetary File System (IPFS), a decentralized file storage system that can be altered using dynamic metadata.

Unlike ordinals, NFTs can also support creator royalties.

Finally, the inscriptions on ordinals cannot exceed the 4MB bitcoin block size limit, which is not true for NFTs.

Due to the differences between NFTs and bitcoin ordinals, Rodarmor refers to the latter as “digital artifacts.”

The Impact on Bitcoin Network Congestion and Fees

Despite their innovative nature, ordinal inscriptions have raised concerns within the bitcoin community.

Adding large amounts of non-transactional data might compete with traditional bitcoin transactions for block space, potentially increasing transaction fees and prompting miners to prioritize higher-fee ordinals transactions, which could negatively impact the broader use of bitcoin as a means of exchange.

For example, if most dollar banknotes had autographs on them, people might not use them for their nominal value but for the value of the content, affecting money flow and velocity.

However, as of today, ordinals don’t affect fees much, and the increase in miner revenue is unnoticeable.

How to Inscribe Your Own Ordinal

One can create bitcoin ordinals through two primary methods:

For technically skilled users, you can run a full bitcoin node and install ordinal software. This allows you to inscribe satoshis and create bitcoin ordinal NFTs. This method requires a Taproot-compatible bitcoin wallet with coin control capability, such as Sparrow (for receiving ordinals) or Ord wallet (for creating inscriptions). The Ord wallet also prevents accidental spending of inscribed satoshis. Both wallets require some BTC for transaction fees.

A more user-friendly method involves no-code tools like Gamma or Ordinalsbot.com. These platforms enable you to inscribe your ordinal NFT more simply, making the process more accessible for non-tech-savvy users.

Investor Takeaway

Bitcoin ordinals have been around for only a few months and haven’t changed the rules of the bitcoin ecosystem, but they have tremendous potential in the long term. The main selling point is that no one can censor the content attached to sats, while collectibles benefit from unmatched security due to being stored directly on-chain.

Just as we saw with NFTs on Ethereum, we should see a rise in bitcoin ordinals trading on secondary markets. This is bound to lead to more interest from investors eager to leverage their unique capabilities. It’s also possible that some of these ordinals could see a massive uptick, if and when the overall market for NFTs recovers.

As is the case with NFTs, so too bitcoin ordinals present various methods for generating income. These include buying high-quality ordinals at a low price and holding them long term, bulk-minting niche project ordinals and later selling them at a higher price, and identifying potentially profitable categories of ordinals for high-frequency trading.

bitcoin market journal

Hodlnaut

Download our NFT Investor Scorecard for a fill-in-the-blank framework for rating NFT investments, including bitcoin ordinals.