For many investors, it’s all about earning investment income. Maybe you’re building a nest egg or you want to retire early. You could be a die-hard investor or a newbie in the DeFi space. Either way, earning investment income is easier than ever in the burgeoning DeFi market. Compound is a protocol that allows you to do just that.

What is Compound and How Does It Work

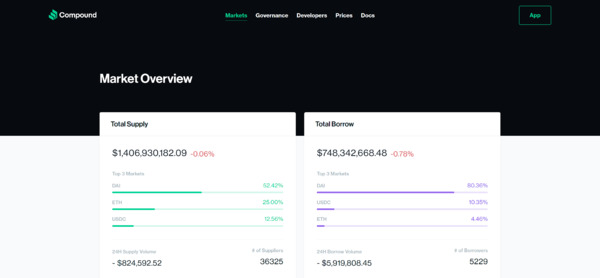

Compound is a money market protocol that allows for short-term lending and borrowing of Ethereum-based assets. It’s one of the most popular applications in Ethereum’s DeFi stack.

Compound operates within Ethereum’s infrastructure and lets users put up their Ethereum-based assets to liquidity pools that immediately earn them compounding interest.

The interest is determined by an algorithm that calculates current liquidity and market utilization. It is more volatile than in a traditional institution but it accrues much more rapidly thanks to a higher interest rate.

Users can borrow against collateral using any of the supported markets including:

- ETH

- USDC

- Dai

- Sai

- REP

- WBTC

- ZRX

- BAT

Currently, Dai is the highest-earning among all of them and there are no extra fees associated with using the platform. Its upgraded v2 protocol has been formally verified and security audited.

The core logic of the Compound protocol is contained in cTokens, which are given an interest rate and a risk model, allowing users to supply and redeem their capital as well as borrow and repay.

Users can borrow up to 75% of the total value of their cTokens. The amount they can borrow is based on the quality of the underlying asset. If their debt ever becomes under-collateralized, anyone can purchase the liquidated assets for a 5% discount.

That means individuals with long-term investments in any supported asset can use Compound to earn additional returns.

How to Use Compound

- You must first connect it to your wallet using Coinbase Wallet, Ledger hardware, or the MetaMask interface.

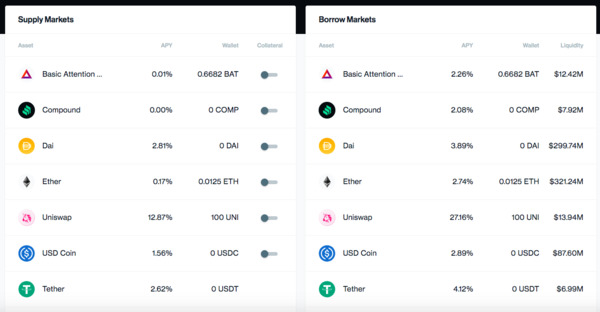

- Once you connect your wallet to Compound, you can view your balances via the Compound web interface. You can also view the available markets along with their current market size, supply APY, and borrow APY.

- Once you select your chosen market, you can either supply or borrow against it and confirm the transaction.

- Once the supply transaction is confirmed, you’ll receive the corresponding amount of cTokens. If you’d like to redeem your assets, you can withdraw them again.

Should the platform ever get compromised, Compound has implemented a centralized administrator key, maintaining a single point of failure. This adds security to the otherwise unregulated DeFi environment.

Yield Farming

Yield farming is one of the hottest trends in DeFi right now. Investors have started leveraging different protocols and products to get a significant return on assets. In some cases, investors are earning well over 100% APY by combining token incentives with lending interest.

Yield farming became popular when Compound began its live distribution of COMP. Liquidity providers who deposit funds in Compound’s poosl are rewarded with COMP tokens in addition to the interest earned. As a result, DeFi users are incentivized to deposit more into the protocol to earn higher yields.

Compound may have started the frenzy, but shortly thereafter, other players entered the market, like Balancer and SushiSwap.

How to Make Money on Compound

On Compound, you can invest your digital funds in the asset that’s currently earning the most interest, or you can borrow against your existing assets. You can even monitor the platform for the top-earning assets of the day and move your assets around accordingly. For Compound, liquidity is king.

However, for those who are more interested in putting their assets up to earn interest without working at it can still “set it and forget it,” so to speak. No matter whether you move your assets every day, every week, every month, or never, it will continue to earn the current APY according to Compound’s algorithm.

On the other hand, for the truly tech-savvy, you can implement a liquidation bot using the Compound API that will scour the platform for unhealthy or underwater accounts. This allows users on the Compound platform to swoop in and buy back liquidated assets that were under-collateralized at a 5% discount, growing their profiles and allowing them to reinvest and earn even more interest.

Diligent yield farmers are taking advantage of this unique feature to earn far more than they would otherwise on any other platform.

Final Thoughts

The Compound protocol is one of the many ways you can earn interest on your Ethereum-based digital assets. There are no fees associated with using the platform, which makes it a great choice for anyone, whether you’re interested in monitoring it closely or letting it work on its own.

Compound has been hard at work revolutionizing the DeFi industry by offering a unique protocol that is easy to use and offers more token incentives than other platforms. They make yield farming less complicated and far easier to understand, even for those who simply want to dabble.

Related Articles:

- What is DeFi?

- Top 10 DeFi Platforms in 2020

- What is Yield Farming and How Can You Make Money With It?

For daily updates on the digital asset markets, subscribe to Bitcoin Market Journal today.