Yield farming is emerging as one of the most popular ways investors can earn investment income on their digital asset investments.

But how does yield farming work, and can you really make money with it?

What Is Yield Farming?

Yield farming gives people the chance to earn investment income by placing funds in a DeFi (decentralized finance) protocol.

An investor deposits digital assets in a lending or market-making protocol to earn interest or fees in exchange for providing liquidity. As an additional incentive, users typically also receive extra yield in the form of the protocol’s governance token.

For example, a yield farmer can lend ETH on Compound and earn a yield based on how much Compound charges borrowers for ETH loans. Additionally, the liqudity provider also receives COMP tokens in relation to the amount they contribute to the borrowing and lending pool.

To start digging in the fields of yield farming, you have to pay to play. If you’re only throwing in a few hundred dollars, the fees will likely eclipse any earnings you realize. With larger investments, however, the rate of return can more than cover the fees, positioning you to realize consistent profits.

How Yield Farming Works: Liquidity Pools

All lending schemes depend on the liquidity of the asset being lent. If a bank didn’t have money, it couldn’t provide loans. Similarly, a DeFi player like Compound Finance needs digital assets to lend to others. This is where yield farmers come in.

Yield farmers deposit digital assets into a liquidity pool to enable the protocol to fulfill its purpose.

In the case of Compound, it provides liquidity to borrowers who are looking to borrow funds in digital currency. In Compound Finance’s system, this is done using smart contracts on the Ethereum blockchain. The smart contracts connect lenders and borrowers and calculate how much interest the borrower pays.

In exchange for providing liquidity, yield farmers – also known as liquidity miners – receive newly minted COMP tokens in addition to interest paid by the borrowers.

How Yield Farming Works on Compound Finance

Compound Finance is currently one of the leading protocols in the DeFi space. The decentralized lending application offers a straightforward process for yield farming newcomers. The steps are as follows:

1. Connect Your Wallet

If you have a wallet such as Ledger, Metamask, or Coinbase Wallet, you can link it with the Compound Finance app. During the connection process, you give Compound Finance access to the digital funds in your wallet.

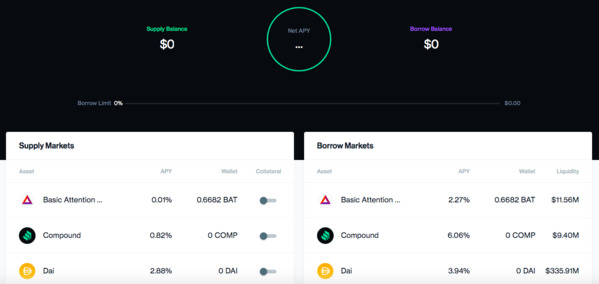

2. Check Out the Interest Rates

Once inside the Compound Finance app, you can peruse the rates of return for providing liquidity to the money market protocol. The rates change based on demand and other market conditions, so what you see one day may be significantly different later.

3. Lending

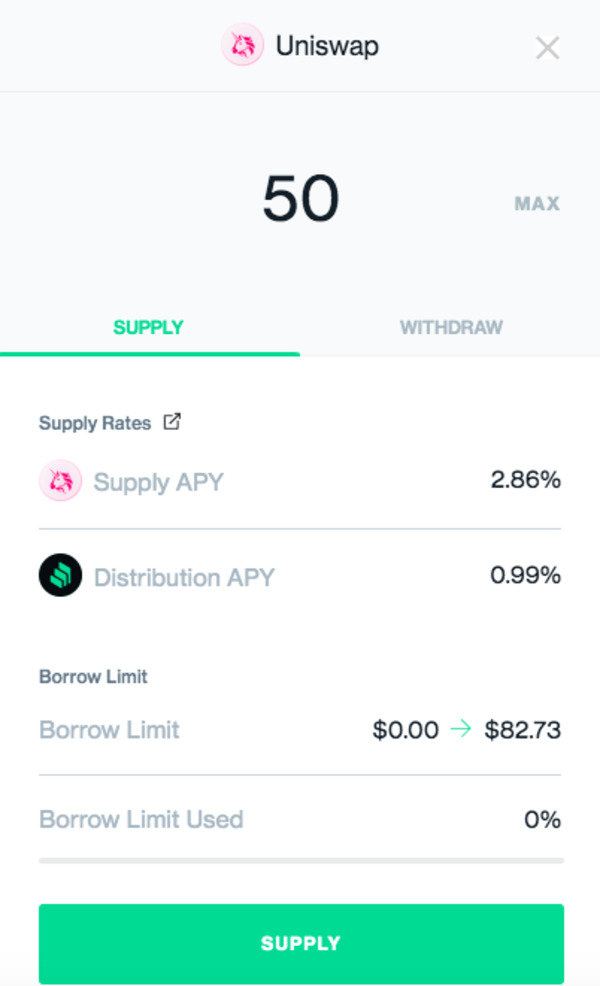

In order to use Compound Finance, you have to supply a digital asset, such as ETH, USDC, or DAI. To do so, you have to approve a lending asset using your Ethereum wallet, and then deposit the amount you would like to place in a pool.

At this point, you will see how much interest you will earn, and how much APY in COMP tokens you can expect.

Once you have deposited your funds, you will start to earn interest and COMP tokens, making you a bona fide yield farmer on Compound.

Further Reading:

- What Is DeFi?

- Top 10 DeFi Platforms in 2020

- Blockchain Investing 101: How to Build Long-Term Wealth in the Digital Asset Markets

To learn more about the latest development in DeFi and the broader digital asset markets, subscribe to Bitcoin Market Journal today.